Become a RupeNet Onboarding Partner

Earn ₹20,000+ Monthly from Your Local Area

RupeNet is a financial technology company focused on delivering essential banking and digital payment services

to rural and underserved communities in India. Through a network of local merchant partners and providing

solutions like AEPS (Aadhaar Enabled Payment System) for Cash Withdrawal /Deposit, utility bill payments, and

mobile recharges. RupeNet is bridging the gap between urban financial systems and Bharat's grassroots economy.

We require hard working professionals in the sales field who want to earn extra income with the help of their

existing network or students who are eager to learn and gain experience in the marketing field along with

earning a side income. Join us in this mission and make a Digital India together!

💼 What Is an Onboarding Partner?

An Onboarding Partner is an individual who helps RupeNet expand its merchant network (shop owners who provide

these services to local people) by:

- Visiting local shops and kirana stores

- Explaining AEPS and RupeNet services

- Onboarding shopkeepers onto the platform

- Assisting with biometric setup and KYC (of the merchant)

It’s a part-time or full-time earning opportunity that’s perfect for students,

medical reps, or field agents

.

💸 What Do You Earn ?

- ₹500 per agent(After First Successful Transaction) [that means even if you onboard just one

merchant per day on part-time basis for 25 days a month then you can earn ₹12500💰 ]

- Commissions up to Rs 10,000 every year by the merchants you onboard(Yes, that’s right!

Whenever a merchant onboarded by you does a transaction, you receive part of the commission ranging from 0.5-4

Rs per transaction)

- Work once & earn for the whole year (if you onboard 50 Merchants and earn commission for

all those merchants)

- Branded T-Shirts & Exclusive Perks

- Exciting Rewards 🏆

- Recognition & Certification from Rupenet

- Fast-Track to a Full-Time Job!

📲 What Are the Steps to Get Hired?

- Fill the Google Form

- Contact Your Local Key Account Manager (KAM) with the following documentation,

- Passport-size photo

- PAN Card

- Aadhaar Card

- Cancelled cheque (for settlement account)

Note: All AEPS transactions must be done within a 20 km radius of your signup location.

- Admin Activation:Once documents are submitted, your profile is reviewed and activated by

the admin team.

- KYC & Fingerprint Registration:Using your fingerprint biometric device, perform one-time

KYC authentication.

⚠️ Use L1-registered biometric devices for long-term compatibility (currently, L0 also accepted).

- 2FA Login for Security:Before doing any AEPS transactions, you must perform a 2-Factor

Authentication login each day.

- Start Onboarding Merchants!:Now you’re ready to onboard local shopkeepers and help them

become RupeNet Merchant Partners!

🔧 How to Set Up the Biometric Device?

- Enable OTG on your Android phone

- Download RDService from the Google Play Store

- Open RDService and wait for the “Device Ready” message

- Minimize it and launch the RupeNet app

🔗 Apply Now

Want to start earning? Connect with a RupeNet KAM or apply via our onboarding form!

Empower Bharat, one merchant at a time — with RupeNet.

Start Your Own Digital Business with RupeNet — Offer Financial Services & Earn Daily!

In today’s digital Bharat, millions of people still travel long distances for basic banking

services. That’s

where you — a local Money Officer with RupeNet — can change lives

and earn a steady income doing it.

If you run a shop, medical store, or want to start a side business with no upfront investment, RupeNet

is your

launchpad.

💡 What is a RupeNet Money Officer?

A Money Officer is a certified merchant partner who uses RupeNet’s mobile app to offer

essential financial

services to customers. All you need is a smartphone, Aadhaar-enabled biometric device, and internet access — and

you're ready to earn from Day 1.

🛠️ Services You Can Offer

AEPS (Aadhaar Enabled Payment System)

- Cash Withdrawal, Balance Enquiry, Mini Statement using Aadhaar authentication

- ✅ Up to ₹10 per transaction

- Ideal for customers without debit cards or bank branches nearby

DMT (Domestic Money Transfer)

- Transfer money instantly to any Indian bank account

- ✅ Earn ₹8–₹46 per transaction, depending on the slab

- Available 24/7 — even when banks are closed

BBPS (Bharat Bill Payment System)

- Pay electricity, water, broadband, gas, DTH, and other bills

- ✅ Get ₹5–₹15 commission per payment

Mobile & DTH Recharge

- Recharge any mobile or TV connection — across all operators

- ✅ Earn up to 0.85% commission

Credit Card Bill Payment

- Accept and process credit card bill payments from your customers

- ✅ Earn 2.15% commission per transaction

Loan Repayment & Insurance Premium Collection

- Help customers pay EMI and insurance dues right from your shop

- ✅ Fixed commissions up to ₹25 per transaction

💰 How Much Can You Earn?

Here’s a realistic scenario:

| Service |

Daily Volume |

Avg. Earning/Txn |

Daily Income |

Monthly Income |

| AEPS |

20 txns |

₹11 |

₹220 |

₹6,600 |

| DMT |

10 txns |

₹15 |

₹150 |

₹4,500 |

| BBPS |

5 txns |

₹10 |

₹50 |

₹1,500 |

| Recharge |

10 txns |

₹3 |

₹30 |

₹900 |

| Total |

— |

— |

₹450/day |

₹13,500+ |

Multiply this by growing transaction volume — and your monthly income can exceed ₹20,000

easily without any investment or change in your current business.

🧭 Why Choose RupeNet?

- ✅ No investment required

- ✅ Training and onboarding support

- ✅ Real-time dashboard to track your earnings

- ✅ Trusted by 30,000+ agents across 15+ states

- ✅ High commissions, fast payouts

🎯 Ready to Become a Money Officer?

Turn your shop into a digital bank. Serve your community and earn daily with RupeNet.

Why RupeNet Payments is Built for Compliance -

A Secure Platform Against Money Laundering Risks

The Fintech Wake-Up Call: API Misuse and the Increasing Risk of Money Laundering

In a recent expose by The Economic Times (April 2025), the financial services sector was rocked by reports of

massive misuse of payout APIs. Several rogue operators allegedly funneled crores of rupees

using layered

accounts, third-party platforms, and loose onboarding norms, drawing urgent attention from the

RBI and the

Financial Intelligence Unit (FIU).

While this raises concerns about digital finance vulnerabilities, it also presents a moment of reflection—and

leadership.

At RupeNet Payments, we've always believed that trust is the foundation of every

transaction. That’s why, long

before these headlines, we implemented a Compliance-First Framework designed to prevent

exactly this kind of

misuse.

RupeNet’s Built-In Compliance & Risk Controls

1. Aadhaar-Based KYC for Every DMT Remitter

Unlike many platforms that allow anyone to send money with minimal checks, RupeNet mandates that

every

Domestic Money Transfer (DMT) remitter [normally the local Shop Owners] is KYC-verified

using Aadhaar

authentication. This ensures:

- Proof of identity & address

- Biometric traceability

- Real-time duplication checks

This drastically reduces the possibility of ghost users and mule accounts.

2. OTP-Based Transaction Authorization

Each transaction made by a remitter on RupeNet goes through a secure OTP verification,

ensuring the genuine

intent and consent of the user. This:

- Prevents impersonation or third-party misuse

- Creates an audit trail for each transaction

- Enables user-level accountability

3. Risk & Compliance System (Implemented in 2024)

RupeNet was one of the first rural-focused fintechs to deploy a dedicated Risk &

Compliance Unit last year. Our in-house team actively:

- Flags suspicious patterns (high frequency, unusual volumes)

- Suspends or escalates questionable accounts in real time

- Works in sync with our partner banks and payment gateways

4. What Went Wrong Elsewhere?

From the recent report, key issues identified were:

- Overexposed APIs shared without restrictions

- Weak onboarding of payout agents and BCs

- Lack of OTPs, KYCs or facial authentication

- No audit trail of purpose for fund transfers

These gaps created a loophole for layering and laundering across dozens of accounts, many of

which were shell entities.

RupeNet’s Compliance-First Infrastructure = Peace of Mind

| Feature |

RupeNet Approach |

| Remitter Onboarding |

Aadhaar-Based eKYC |

| Transaction Authentication |

Mandatory OTP for Every DMT |

| Agent Verification |

KYC + Field Verification by KAMs |

| Risk Monitoring |

24x7 Pattern & Volume Surveillance |

| Partner Bank Coordination |

API Whitelisting & Daily Audit Logs |

A Message to Our Merchants and Partners

At RupeNet, we’re more than a payments platform—we’re a responsible ecosystem builder. Our

Merchant Partners

can transact confidently knowing they’re part of a legally compliant, RBI-aligned, and

financially secure

network.

We are actively working with our banks and regulators to maintain the highest standards of due

diligence,

especially in rural markets, where protection is essential.

Our Philosophy

Fintech is evolving. But with evolution comes responsibility.

We believe that financial inclusion must go hand-in-hand with financial discipline.

RupeNet’s early adoption of KYC, OTP, and proactive monitoring sets a strong precedent for

compliance-driven growth. As others play catch-up, we continue to stay ahead—building a platform that’s not

just easy to use, but safe to trust.

Start Your Own Digital Business with RupeNet — Offer Financial Services & Earn Daily!

Introduction

In a major move to enhance security and trust in Aadhaar-based services, the Unique Identification Authority

of India (UIDAI) has rolled out new biometric authentication guidelines. These updates

mandate a shift to Level 1 (L1) fingerprint scanners, encourage face authentication, and

introduce two-factor biometric verification in sectors like telecom.

We’re proud to announce that RupeNet is among the first payment platforms in India to

fully comply with these UIDAI protocols — making your transactions safer, faster, and

future-ready.

What’s New in UIDAI Guidelines?

Here’s a snapshot of the latest mandates:

- ✅ Mandatory upgrade to L1 fingerprint scanners

(All L0 scanners to be phased out by June 30, 2025)

- ✅ Rapid growth in Face Authentication

(Over 130.5 crore authentications, with 78% in FY 2024-25 alone)

- ✅ Two-Factor Authentication (2FA)

for Aadhaar in telecom: fingerprint + face

- ✅ UIDAI Circular 3 of 2024 outlines Aadhaar use in receiving subsidies/services

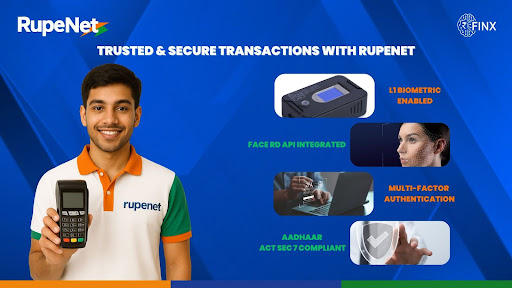

RupeNet’s Early Compliance: Leading by Example

RupeNet has already:

- Upgraded to L1 biometric devices

- Integrated Face RD API into our app

- Implemented multi-factor Aadhaar authentication

- Complied with Aadhaar Act Section 7 for government benefit transactions

This means your transactions — whether AEPS, DMT, or BBPS — are now more secure, faster, and aligned

with national compliance frameworks.

What This Means for Our Money Officers & Users

Whether you're a Money Officer, merchant, or distributor:

- You’ll benefit from seamless Aadhaar-based transactions

- You’re operating with a UIDAI-certified platform

We provide training and support to help you use these features easily with your existing

smartphone and RupeNet biometric device.

A Story of Strength, Dignity, and Digital Empowerment

In a remote village tucked away in Karnataka, where banking access was once a dream and opportunities were scarce, one man is quietly rewriting the script of resilience — one transaction at a time. Meet Anjinappa, a RupeNet Money Officer whose story isn’t just about earnings or digital tools, but about the undying human spirit.

A Journey That Defied Expectations

Born with a disability in both legs, Anjinappa grew up with more limitations than most. In a world that often judged him for what he couldn't do, he dared to believe in what he could.

When RupeNet reached his village, it wasn’t just another digital platform. It was a turning point.

Armed with only a smartphone, a biometric device, and an unbreakable will, he became his village’s Money Officer — or as locals now say, “Money Officer Anjinappa.”

Serving His Community with Heart and Purpose

Today, Anjinappa runs a micro financial hub right from his modest home. Every morning, villagers line up — not just for cash, but for trust and support.

- Pensioners withdraw monthly entitlements

- Daily wage workers to access wages locally

- Women recharge mobile phones and pay electricity bills

- Villagers perform Aadhaar-based cash withdrawals (AEPS)

He isn’t just processing transactions — He’s the lifeline of his village’s financial ecosystem.

More Than a Money Officer

Wearing his RupeNet T-shirt with pride, Anjinappa doesn’t stand on legs — he stands tall with courage, purpose, and resilience.

“I’m not just earning. I’m changing lives — including mine,” he says with a calm smile.

To his community, he is no longer seen through the lens of disability — but as an example of what’s possible when meets opportunity.

Be Like Anjinappa — Join the RupeNet Mission

This story isn’t just his. It’s a call to everyone — with or without physical limitations — to contribute to society, serve their community, and build a dignified life.

All you need is your phone, your willpower, and RupeNet.

- ✅ Offer banking services

- ✅ Earn daily commissions

- ✅ Become your village’s digital leader

🌐 Join us now

📲 Download the App

UPI QR Codes: Boosting Financial Inclusion in Rural India with Rupenet Payments

India is witnessing a digital revolution in payments, and at the center of it is the Unified Payments Interface (UPI).

Among its most powerful tools, UPI QR codes have become a driving force for financial inclusion — especially in rural India,

where access to traditional banking services has always been limited. With platforms like Rupenet Payments,

this transformation is reaching deeper into villages, empowering people and businesses like never before.

Breaking Barriers in Rural Finance

For years, villagers had to travel miles to reach a bank or ATM. Today, with Rupenet Payments enabling UPI QR transactions,

even the smallest shop or roadside vendor can accept digital payments instantly.

No need for expensive machines or complex setups — just a QR code and a mobile phone.

Empowering Merchants and Farmers

Rupenet Payments is making it easier for rural merchants and farmers to go cashless by:

- ✅ Accepting instant UPI payments through QR codes

- ✅ Reducing cash-handling risks, ensuring safer transactions

- ✅ Improving cash flow with instant settlement into bank accounts

- ✅ Building digital trust, as every transaction is transparent and recorded

For farmers, receiving payments directly into their bank accounts not only provides security but also

opens access to loans, subsidies, and other financial services.

Spreading Digital Confidence in Villages

Through awareness initiatives and user-friendly solutions, Rupenet Payments is helping rural citizens gain

confidence in using digital transactions. This shift is not only increasing financial literacy but also

connecting more people to the formal financial ecosystem.

The Bigger Picture: A Cashless Rural Economy

UPI QR codes with Rupenet Payments are more than a convenience — they are an entry point to greater opportunities.

With each digital payment, rural India is getting closer to a digitally inclusive economy,

where every citizen has access to modern financial services.

Conclusion

UPI QR codes, powered by Rupenet Payments, are truly boosting financial inclusion in rural India.

By simplifying transactions and empowering local businesses, they are helping create a stronger, more connected,

and financially secure rural economy.